I PROGRAMMI VENGONO FORNITI IN FORMA DI ALLEGATI DI POSTA ELETTRONICA PRESSO L'INDIRIZZO E-MAIL INDICATO DAL CLIENTE.

ESSI, CEDUTI IN LICENZA D'USO ILLIMITATA, RIMANGONO DI ESCLUSIVA PROPRIETÀ DELL EDP CONSULT. E' FATTO QUINDI ESPRESSO DIVIETO AL CLIENTE DI CEDERLI O DARLI IN SUBLICENZA A TERZI O COMUNQUE DI CONSENTIRNE L'USO DA PARTE DI TERZI SIA A TITOLO GRATUITO CHE A TITOLO ONEROSO.

MANAGEMENT OF DERIVATIVE PRODUCTS 188220

€270.00 (In Stock)

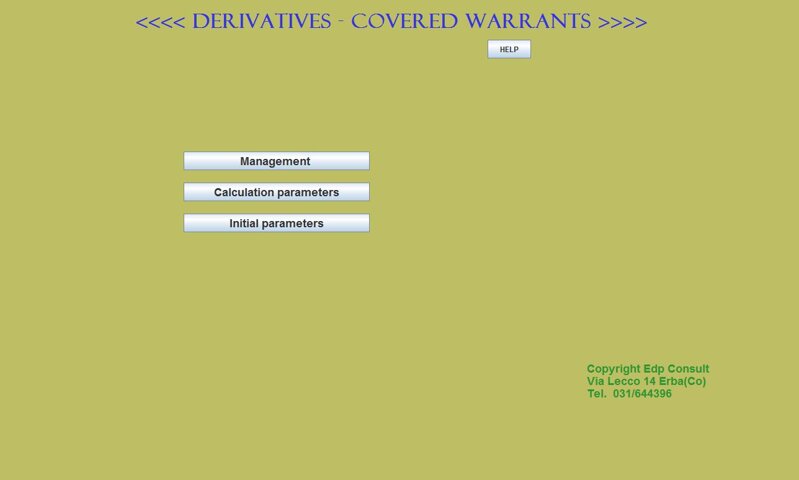

MANAGEMENT OF DERIVATIVE

PRODUCTS

Programme planned to

calculate the future value of the

covered warrants.

The solution allows to

calculate the value of a covered warrant depending on the value of the underlying, the strike, the parity ratio and

the time elapsing from the calculation date to the maturity date. It is necessary to insert the

values of the warrant call and the warrant put with an hypothetic underlying in correspondence

of 5 strategic values (from 0.5 to 1 for

the warrant call and

from 1 to 2 for the warrant put).

The calculation is effected by mathematical interpolation or

extrapolation.

Demo version available.